How Can You Succeed in Trading

Trading can be highly rewarding, but it is also one of the most challenging ways to make money. Many people enter the markets with excitement and big dreams, only to leave disappointed. Success in trading is not about luck—it is about discipline, knowledge, and mindset.

Below are the key principles that separate successful traders from those who fail.

1.Understand That Trading Is a Business

Successful traders treat trading like a business, not a game or a gamble.

You need a clear plan

You must manage risk

You track performance and results

If you approach trading emotionally or casually, the market will punish you.

2.Education Comes First

Before risking real money, you must understand:

How financial markets work

What moves prices

Basic technical and fundamental analysis

Risk management principles

A trader who skips education is paying tuition directly to the market—usually through losses.

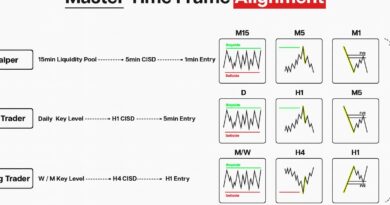

3.Develop a Trading Strategy

A trading strategy is a set of rules that tells you:

When to enter a trade

When to exit

How much to risk

Which markets to trade

Your strategy should be:

Simple

Testable

Repeatable

If you cannot explain your strategy clearly, you don’t have one.

4.Master Risk Management

Risk management is the most important skill in trading.

Golden rules:

Never risk more than 1–2% of your capital on a single trade

Always use stop-loss orders

Protect your capital before chasing profits

You can be wrong many times and still succeed—if your losses are controlled.