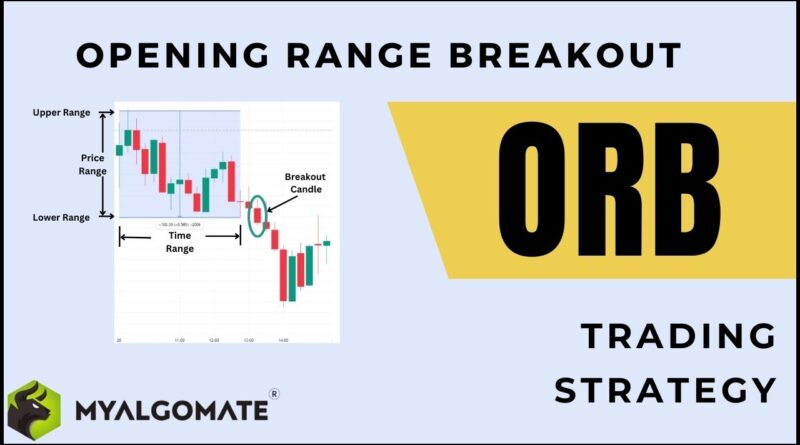

Opening Range Breakout (ORB) Trading Strategy Explained

The Opening Range Breakout (ORB) strategy is one of the most popular and widely used intraday trading techniques in the stock market, forex, and futures trading. Traders rely on this method to capture strong price movements that often occur soon after the market opens. By identifying the high and low of the opening range, traders can prepare to enter trades when the price breaks out of this range with momentum.

What Is the Opening Range?

The opening range refers to the price action during a defined time window after the market opens—commonly the first 5, 15, or 30 minutes, depending on the trader’s style. During this time, volatility is usually higher as buyers and sellers react to overnight news, global market trends, and early order flows.

Upper Range (High): The highest price reached during the opening period.

Lower Range (Low): The lowest price reached during the opening period.

Breakout Point: When the price breaks above the upper range (bullish breakout) or below the lower range (bearish breakout).

How the ORB Strategy Works

1. Mark the Opening Range: Identify the high and low during the chosen opening time frame (for example, the first 15 minutes).

2. Wait for a Breakout: Monitor the chart closely to see if the price breaks above or below the defined range.

3. Confirm with Volume or Candle Strength: A breakout accompanied by strong volume or a clear breakout candle is more reliable.

4. Enter the Trade: Go long if the price breaks the upper range or short if it breaks the lower range.

5. Set Stop-Loss and Targets: A stop-loss can be placed inside the range to manage risk, while profit targets may be based on risk-reward ratios or key support/resistance levels.

Why ORB Is Effective

The ORB strategy is effective because it takes advantage of market momentum and volatility during the opening session. Many professional day traders use it to catch big intraday moves without overcomplicating their analysis. However, like all strategies, it requires discipline, proper risk management, and sometimes confirmation indicators such as VWAP, RSI, or moving averages.