Smart Money Concepts (SMC) Trading Strategy – Step-by-Step Guide

Introduction

Smart Money Concepts (SMC) is a refined trading method designed to follow the footprints of institutional traders—banks, hedge funds, and market makers—who control most of the market’s liquidity. Instead of relying on lagging indicators, SMC focuses on price action, market structure, liquidity, and imbalances to identify high-probability trade setups.

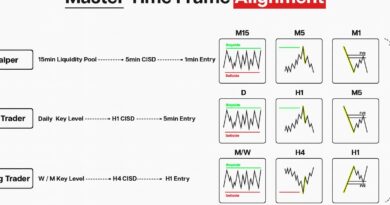

1. Determine the Higher Timeframe Bias

Begin with the 4H or 1H chart to see the bigger picture. The higher timeframe reveals the dominant market direction. Look for a Break of Structure (BOS):

- Bullish bias: Price breaks a previous higher high with strong momentum.

- Bearish bias: Price breaks a previous lower low decisively.

This step filters out trades that go against the trend.

2. Identify Key Supply & Demand Zones

Mark Order Blocks (OB)—the last bullish candle before a bearish move (supply) or the last bearish candle before a bullish move (demand). These are where institutions placed large orders.

Also, look for Fair Value Gaps (FVG)—imbalances where price moved quickly, leaving unfilled orders. These areas are often revisited.

3. Look for Liquidity Sweeps

Institutions hunt for liquidity before making their real move. This often means pushing price above recent highs or below recent lows to trigger stop losses and grab pending orders. Wait for this sweep, then watch for rejection signals.

4. Refine the Entry on Lower Timeframes

Drop to 1M or 5M charts once the higher timeframe bias is confirmed. Look for:

- CHoCH (Change of Character) signaling a shift in direction.

- A smaller OB inside the higher timeframe zone.

- An FVG entry aligned with the overall bias.

5. Risk Management & Profit Targets

Risk 1-2% per trade. Place stops just beyond the liquidity sweep or OB. Target the next liquidity pool or opposing zone. This ensures a healthy risk-to-reward ratio.

Conclusion

Trading with SMC means trading with precision, patience, and discipline. By combining HTF bias, institutional zones, liquidity concepts, and refined entries, traders can align themselves with market movers and improve their win rate while avoiding unnecessary trades.

I take pleasure in, lead to I found just what I was having a look for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

Thank you