Understanding Liquidity in Trading: Internal vs External

Liquidity is one of the most important concepts in trading, yet it is also one of the least understood by beginners. Every candle that forms, every breakout, every reversal, every sudden spike—those movements are not random. They happen because the market is constantly searching for liquidity. When you understand where liquidity is located, you begin to understand why price moves the way it does. The goal of this simplified explanation is to help you clearly understand the difference between internal liquidity and external liquidity, and how these two concepts apply to real trading decisions.

External Liquidity (Outside the Structure) External liquidity is found above major swing highs and below major swing lows. These areas contain stop-losses, breakout buy stops, breakout sell stops, and large clusters of pending orders. Retail traders usually place their stops in predictable places, which makes these zones extremely attractive for smart money. Before a real move happens, price often goes to take those orders.

Examples of external liquidity:

• Stops above equal highs

• Stops below equal lows

• Liquidity pools at obvious support and resistance

• Buy stops above consolidation highs

• Sell stops under consolidation lows

When the market sweeps external liquidity, the move is usually quick and sharp—a wick, a spike, or a sudden breakout that fails. This is not the real trend. It is simply price grabbing the liquidity it needs in order to move efficiently. Many traders get stopped out here because they place their stops exactly where the liquidity pool is located.

Internal liquidity is important because it tells you where the market might retrace before continuing the main move. Instead of chasing price, smart traders wait for price to return to an internal liquidity zone, show rejection, and then continue in the overall direction of the trend.

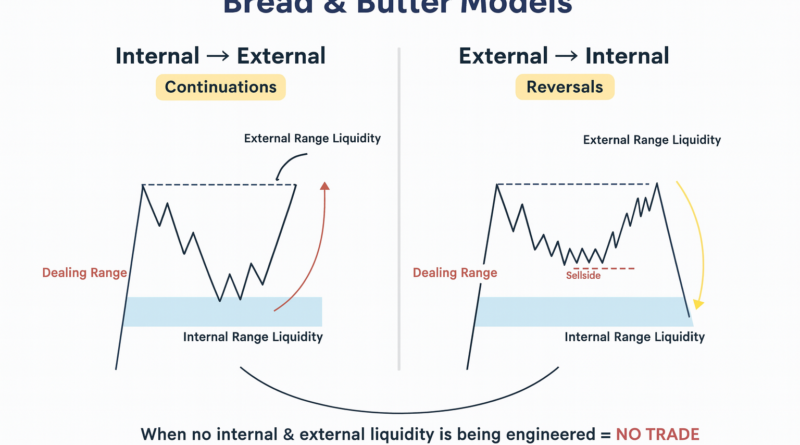

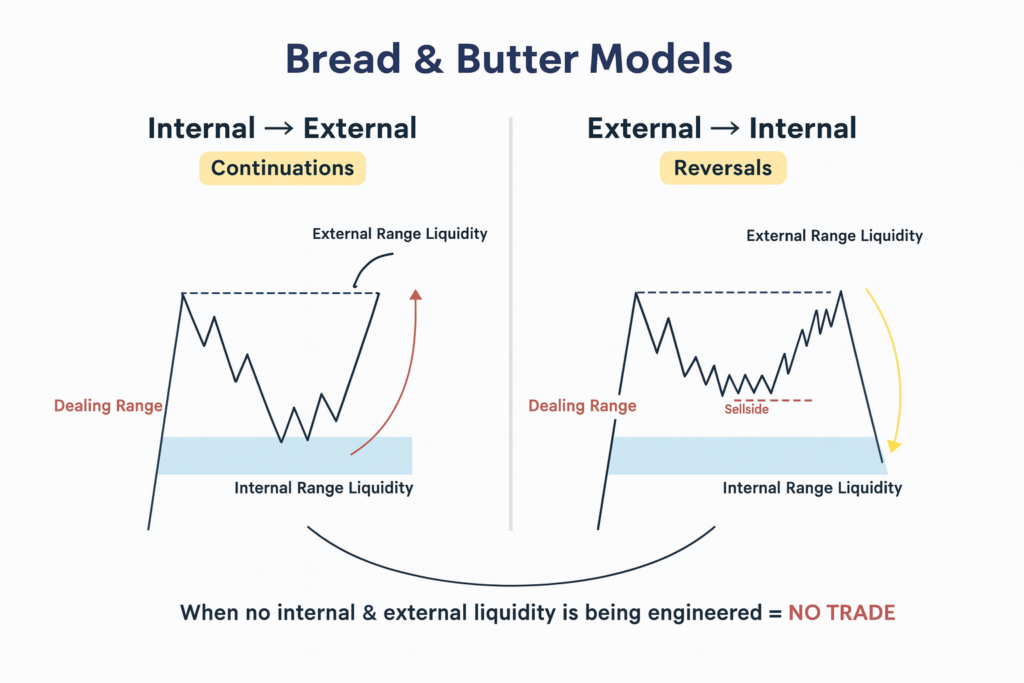

How Smart Money Uses Both Types of Liquidity

Smart money does not trade randomly.

They follow a repeated sequence:

1. Build internal liquidity inside a range

2. Sweep external liquidity above or below the range

3. Then move price toward the opposite liquidity target

This pattern repeats every day in every market—Forex, futures, crypto, stocks. Price builds liquidity inside a consolidation, sweeps the stops outside the range, and then moves toward the real target. Understanding this sequence helps you avoid traps and align with institutional order flow.